Year End Tax Letters

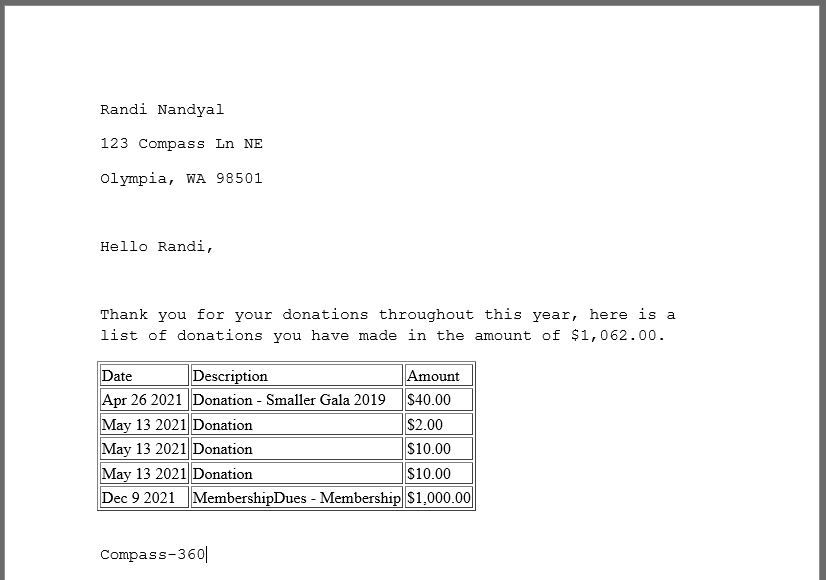

Compass-360 can streamline the process of producing your year end tax receipts for your donors.

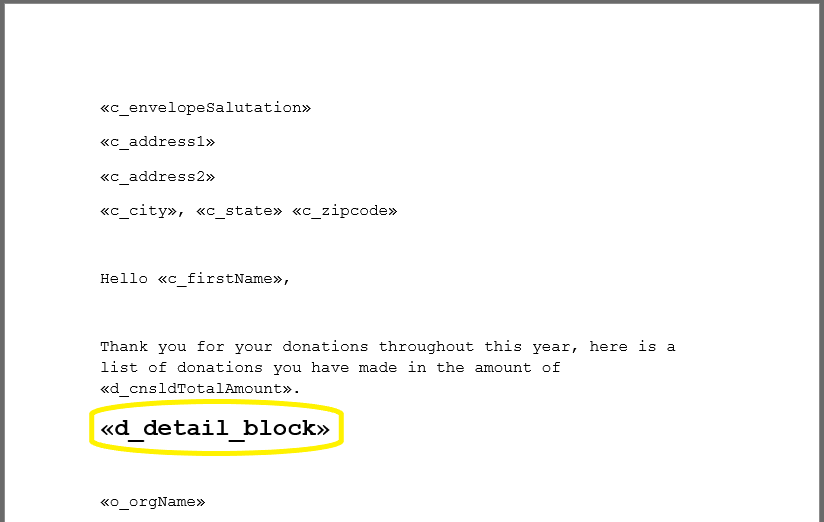

- First, head the the File Cabinet module to create or upload your year end tax letter.

- To produce a detailed list of the constituent’s donations, use the «d_detail_block» merge field, which will list out every donation between the time frame provided.

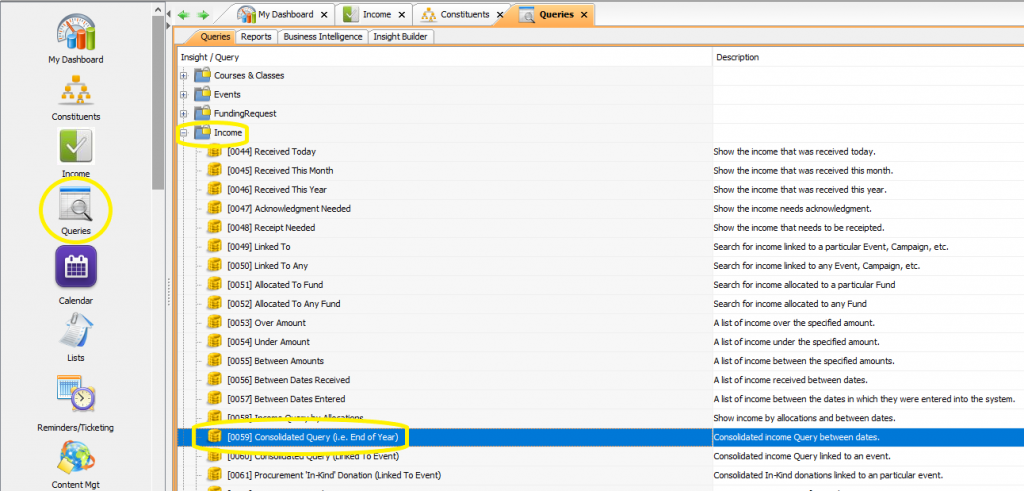

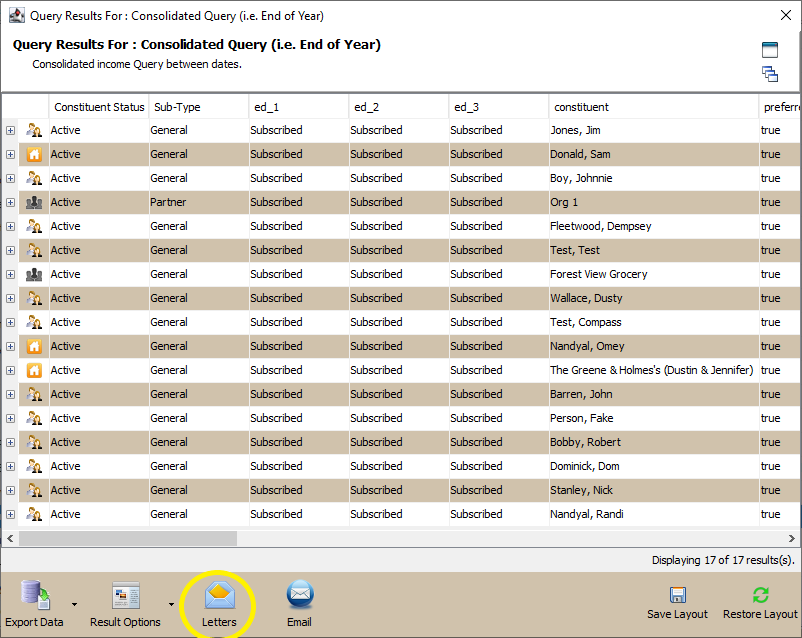

- From the Query Module > Income, run the Income Query [0059] Consolidated Query (i.e. End of year).

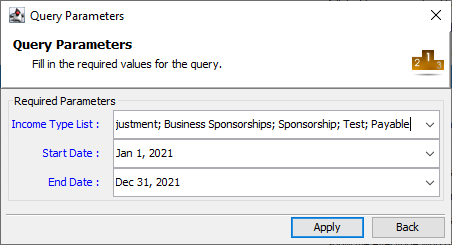

- Choose the income types you want to generate the tax letter for and the date range (likely January-December) you want pull.

- Preview the results of the query, filter and organize the layout as desired.

- Click the Letters button at the bottom of the query to open the mail merge tool.

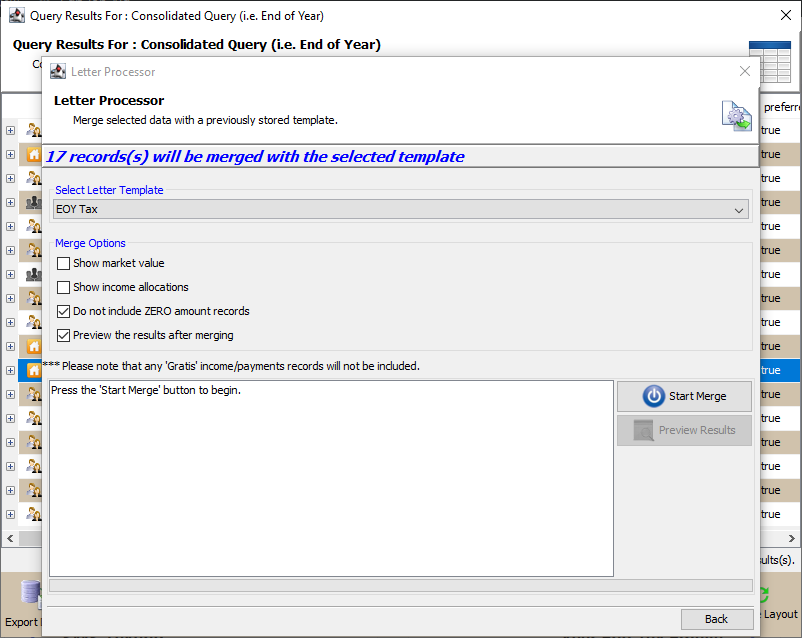

- Confirm the total number of letters to be mail merged.

- Select the year end tax letter from your document list.

- Add market value and allocations if you track these and want to display them for your donor.

- Click the Start Merge button to begin the mail merge.

- Preview the results and print as desired.