Payroll Deductions

Corporate employees have the option to sign-up for payroll deduction, which is essentially making a pledge. However, instead of C360 running a card for each recurring payment, pledges are reported back to the corporation.

Whenever the corporation sends the check for all the pay roll deductions, you can return to C360 and mark the pledges as paid for.

Once the Payroll Deduction pledges have been matched to constituents, you can process the payments when the corporate participant has provided the payroll deductions to you.

When you receive that check, click the Record Income button.

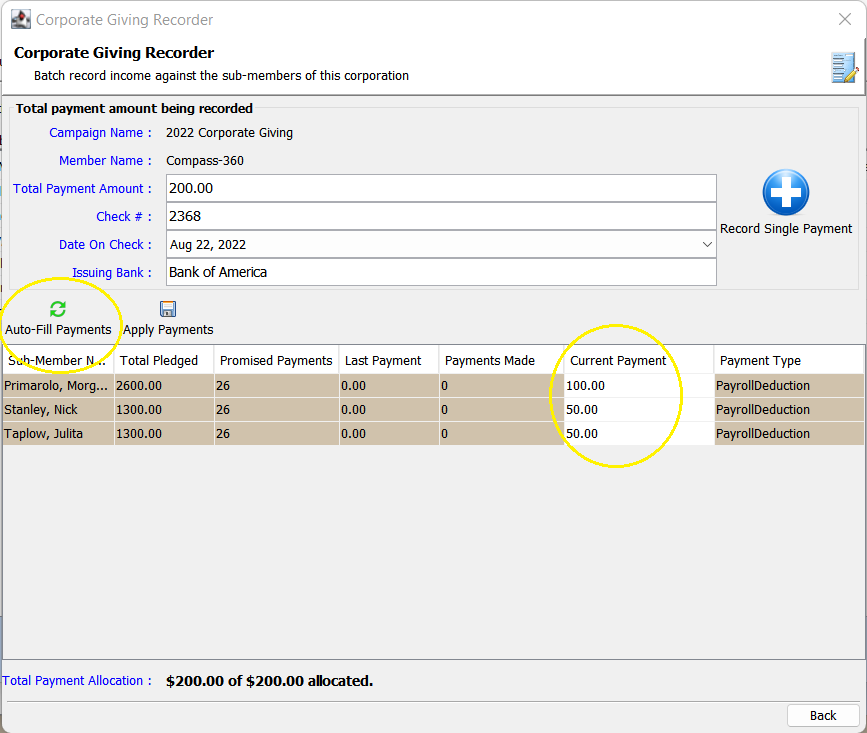

On the Corporate Giving Recorder you will be asked to enter the basic information on the contribution, including:

- Total Payment Amount

- Check Number

- Date On Check

- Issuing Bank

By clicking on the Auto-Fill Payments button, the total payment amount will be distributed accordingly to the employees based upon how much they have indicated they will contribute per paycheck.