Add a Full Income

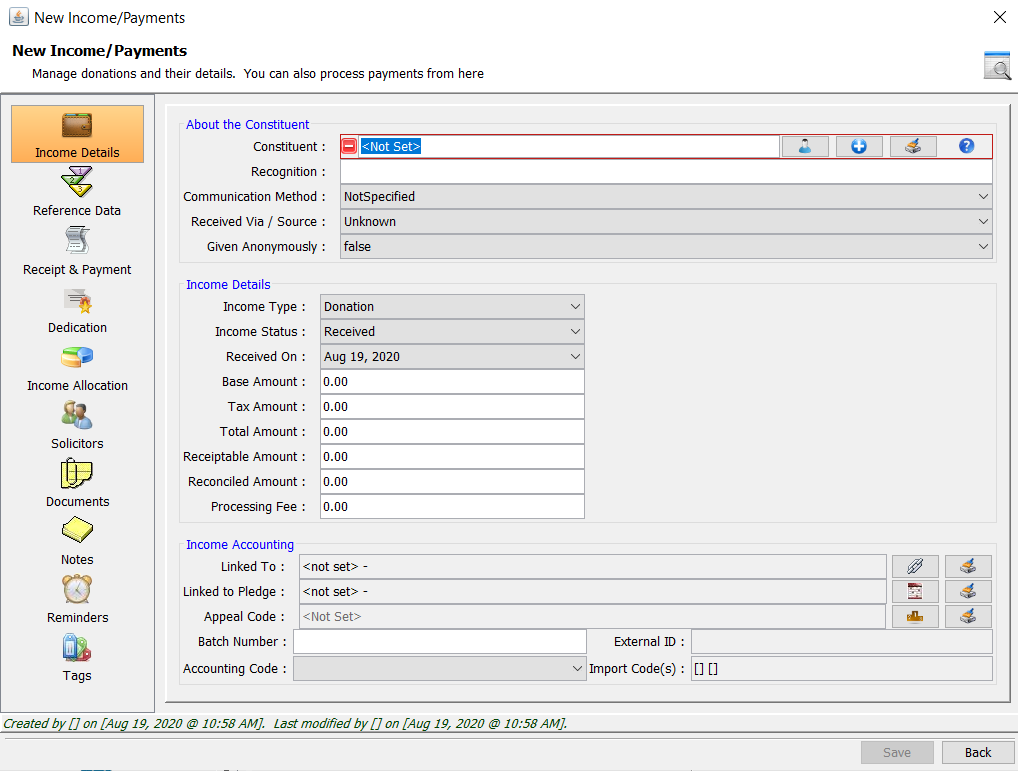

The most commonly used and most powerful method for recording income. In addition to assigning a constituent and payment method, this option provides you with the full set of data recording tools for an income record: linkages to activities, fund allocations, data tags, relationships, notes, donation dedication information, etc.

This is the window and information that opens when editing an existing record.

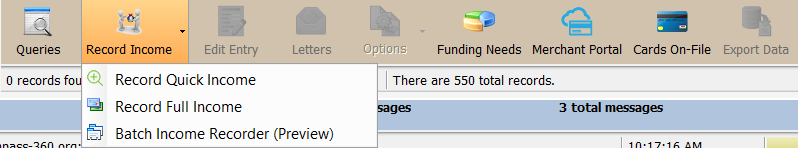

- From the Income Module, select Record Income from the bottom bar and then select Record Full Income.

The ‘full’ window allows you to collect significantly more information about an income record over the ‘quick’ window. It is best to determine what information is relevant for your organization and outline a process for your team to focus on only relevant information. At a minimum, Compass-360 requires that an income entry be associated with a constituent, and contain information about the income type, date, and amount.

Income Details

‘About the Constituent’ Fields

Constituent

Select the constituent this income record will be linked to. Quickly add a new one by clicking

Recognition

How the constituent wishes to be recognized for this income.

Communication Method

How the constituent prefers to be communicated with.

Received Via

Lets you track the method responsible for collecting this income.

Given Anonymously

Indicates that the constituent has requested to remain anonymous.

‘Income Details’ Fields

Income Type

Defines the classification of income received.

Income Status

Allows you to track the current status for the income record. Compass-360 allows you to enter expected income and set the status to receivable.

Received On

The date the income was received. This is separate from the date noted on a check payment.

Base Amount

The amount of the gift. This most often mirrors the total amount except when collecting tax.

Tax Amount

For items that require tax be assigned.

Total Amount

The total amount of the income record including tax if applicable.

Receiptable Amount

Internal use only. Used to denote the amount of the income that is tax deductible.

Reconciled Amount

The amount reflected by your bank net of fees for this income record.

Processing Fee

The additional fee charged by the Merchant Processor for running the transaction.

‘Income Accounting’ Fields

This section allows for additional data linkages to be maintained about the income record.

Linked To

the activity being tracked in Compass-360 that the income record is associated with. Click

Linked to Pledge

If the income record is associated with a pledge being tracked in Compass-360 it will be linked.

Batch Number

Manually assign a batch number if necessary. Online payments will automatically have a batch number assigned from the merchant processor.

Accounting Code

Use for a basic accounting for the income record. For accounting structure with more complexity, use the Income Allocation section.

External ID

Internal use only, used to maintain data from a previously imported record from another database.

Import Codes

Internal use only, used as needed to assign a code to the record as part of an import.

Additional Data Points

Along the left side of the Record Full Income window, you’ll find the full set of data recording tools.

Reference Data

Record external data elements about an income record if tracking across multiple systems.

Receipt and Payment

Record the method of payment associated with the income record as well as acknowledgement status and status of donation receipt if applicable.

Use the Process Payment (cash register icon) to record the payment type. Enter relevant details about the payment type.

Important to note:

For credit card payments, only the card number, CVV and expiration are required to process a card.

Dedication

Record information about a dedication including cross-linking the constituent record that the gift is in memory or honor of. Use the Dedication type and Dedicatee First and Last Name fields to record data that you want to be able to insert into template thank you letters.

You can also record the address of the dedicatee and any special instructions for the notice or gift. Constituents who donate on-line have the ability to include a dedication. Where this is the case, all of the information about the dedication provided by the donor at the time of online payment will appear in this section automatically.

Allocations & Soft Credits

Associate the income record with funds that you have previously defined in the Funding Needs tool and keep track of soft credits for other constituents associated with the income record.

Assigning Allocations

From the Allocations tab, click Add Allocation.

The total amount of the income record will appear by default. Adjust to the correct amount to allocated.

Press the

Choose the appropriate fund to which to allocate the full or partial amount of the income record.

Compass will fill in the Program and Accounting codes that exist with that fund.

Add a custom designation if necessary and any notes about the allocation for the income record. When done, click Save.

Issue a Soft Credit

From the Soft Credits tab, click Add Soft Credit.

Assign the constituent who should receive the soft credit.

Enter the amount of the income record that should be associated as the soft credit. When done, click Save.

Documents

Upload documents that you need to link to the income record. You must first save a newly created record before attaching documents.

Notes

Create notes that you want to add to the income record.

Reminders

Create reminders about this income record for you or other team members. You must first save a newly created record before creating reminders.

Tags

Add custom data fields to the income record that you need to track.